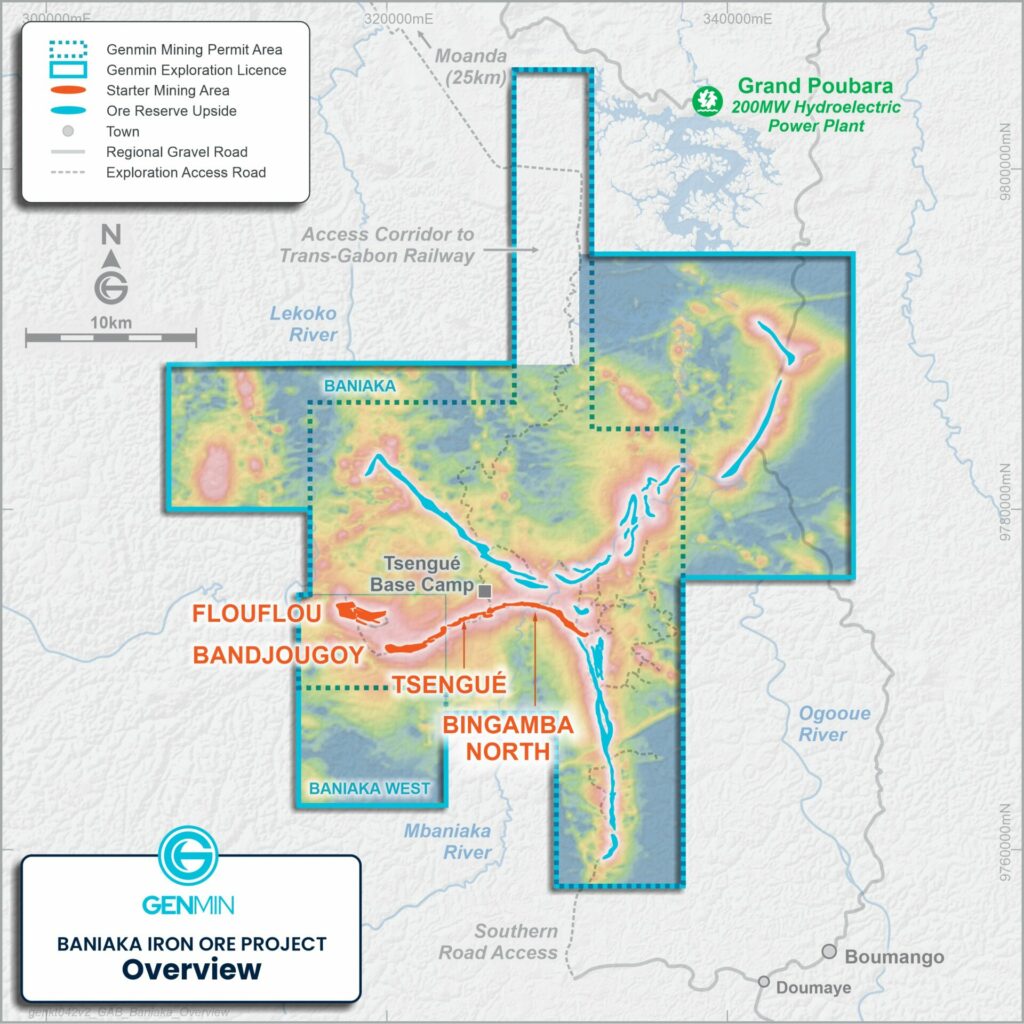

Our 100% owned flagship Baniaka iron ore project located in south-east Gabon, has been awarded a large-scale, 20-year mining permit to support a starter 5Mtpa operation, which is expected to be Gabon's first large-scale iron ore mine.

We submitted an extensive application to the government for a large-scale mining permit for Baniaka, with an initial term of 20 years for a starter 5Mtpa mining operation. The application was supported by techno-economic studies informed by approximately 47,000m of drilling and a comprehensive social and environmental impact assessment. Ministerial approval of the social and environmental impact assessment was provided through a certificate of environmental conformance in August 2023. The large-scale mining permit was approved and awarded by the President of Gabon and together with the environmental approval, provides the regulatory requirements for Genmin to develop and operate Baniaka.

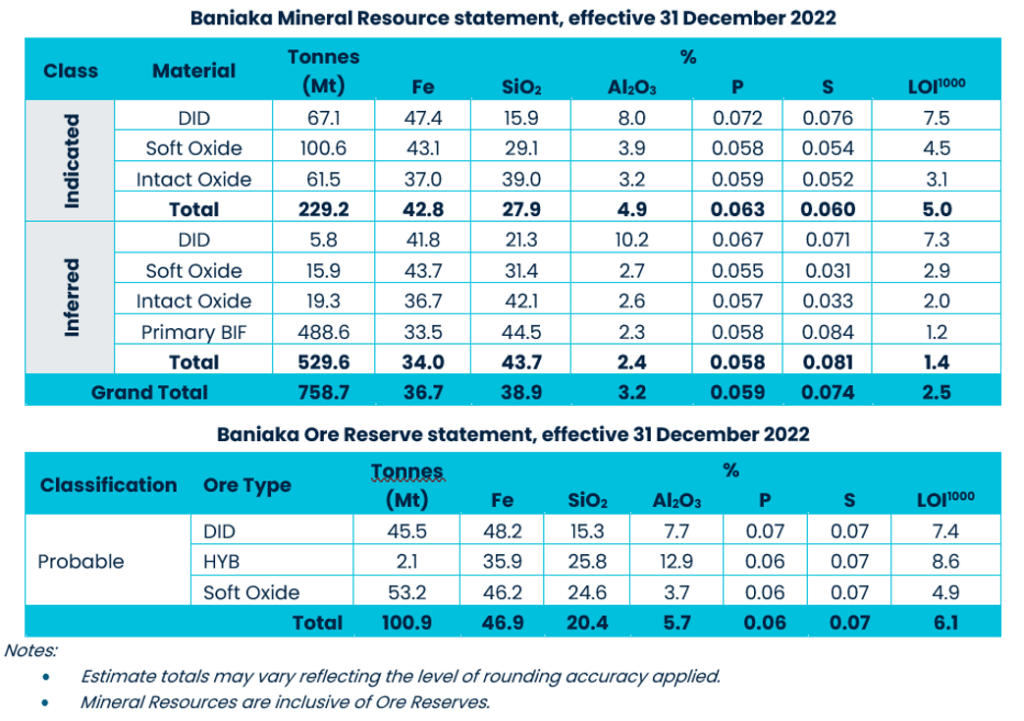

The information on this page that relates to Mineral Resources, Ore Reserves, production targets and forecast financial information derived from production targets is extracted from the Company’s ASX Announcement dated 16 November 2022 titled Positive Baniaka PFS, available to view in the Investors section of this website, and in which Mr Richard Gaze and Mr Allan Blair were the Competent Persons in respect of Mineral Resources and Ore Reserves respectively.

The Company confirms that it is not aware of any new information or data that materially affects the information included in the original market announcement, that all material assumptions and technical parameters underpinning the estimates of Mineral Resources and Ore Reserves in the market announcement above continue to apply and have not materially changed, and that the form and context in which the Competent Persons findings are presented have not been materially modified.